-

Services

-

Software Project Delivery

-

Services

-

Solutions

-

Technologies

-

-

Network

-

Discover

-

Regions

-

Industries

-

Must-Read Guide

-

2026 Global Software Outsourcing Rates and Trends GuideDiscover why rates are just one aspect of the Accelerance Global Software Outsourcing Rates & Trends Guide, which offers valuable insights into the software development landscape.

-

-

-

Resources

-

Our Resources

-

Newest White paper

-

Aviation Ecosystem Modernization: A Holistic Approach for Meaningful TransformationModernize aviation by integrating people, processes, technology, and data

-

-

New eBook

-

The True Cost of Software DevelopmentHidden costs can wreck your budget. Our new eBook breaks down the true cost of outsourcing—get your copy to stay ahead.

The True Cost of Software DevelopmentHidden costs can wreck your budget. Our new eBook breaks down the true cost of outsourcing—get your copy to stay ahead.

-

-

Featured White paper

-

Flow & Process OptimizationIn this white paper, you'll learn to streamline workflows, improve change management, and accelerate results.

-

-

-

About

-

About Accelerance

-

Our History

-

Accelerance: Our HistoryThere's great talent everywhere and great teams everywhere, which is the basis of the Accelerance model.

-

-

Software Without Borders

-

New Episode Every Week!Tune into our podcast Software Without Borders, the essential listen for technology leaders and business owners in the software sector who crave insights from the industry’s top minds.

-

-

Andy's Book

-

Synergea: A Blueprint for Building Effective, Globally Distributed Teams in the New Era of Software DevelopmentPeople are first and locations are secondary when it comes to software development success.

-

-

- Our Clients

August 23, 2022

Holding Strong: Software Development Investment Dodges Cutbacks

Written by: Rich Wanden

In the havoc that is the tech sector, software development seems to be untouchable.

Reports of corporate cost cutting and layoffs are rampant - with some high-profile US tech companies leading the way. But those cuts are largely affecting traditional functions like administration, accounting, HR and marketing.

Amid the belt-tightening, software development investment and outsourcing appear to be holding up - or even on the rise.

Why is that?

-

Companies’ reliance on digital solutions increased during the pandemic and is only going up across industries. Now facing an uncertain economy, executives are looking to automation to cut costs and drive product innovation to defend their market position. Skilled software development underlies both those strategies.

-

A record talent gap still exists for software developers. Around 1.2 million tech-related roles will need to be filled by 2026, according to CompTIA. Only so many positions can be filled in-house and onshore in the US. Outsourcing partners help to fill the excess demand.

-

The fallout from the Great Resignation is still occurring. A backlog of open engineering positions remains, a hangover from those who left their jobs for higher pay, flexibility or other benefits. Many of those positions went unfilled, especially more senior or specialized roles.

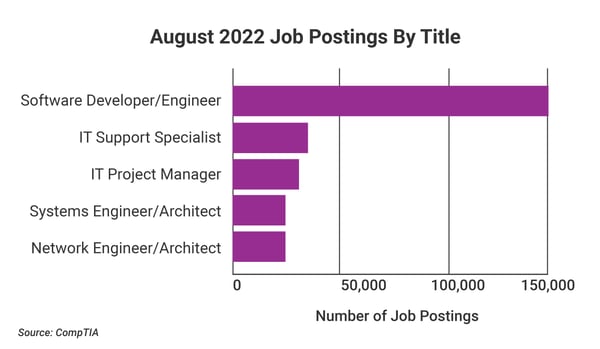

Effect of the Tech Talent Shortage

Software developers and engineers are far and away the most in-demand role in the tech sector. There were 155,501 software developer jobs advertised in the US in July, according to US tech industry body CompTIA. While that was down nearly 35,000 jobs from May as tech companies implemented hiring freezes, it did not make a dent in the approximately one million engineering positions that remain unfilled in the US.

Competition for skilled developers remains fierce. Companies are understandably reluctant to take the knife to their tech-skilled workforce, the engine of innovation for corporate America.

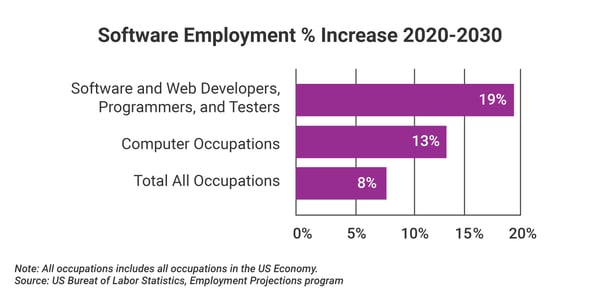

Software development employment is expected to increase by 19% through 2030 - about 2.3 million jobs by 2030 - more than double the rate of growth across all other occupations.

“Many of those openings are expected to result from the need to replace workers who transfer to different occupations or exit the labor force, such as to retire,” the Bureau points out.

Projected Ongoing IT Spend

The growth in labor is a key factor fueling buoyant projections for continued strong investment in the IT sector.

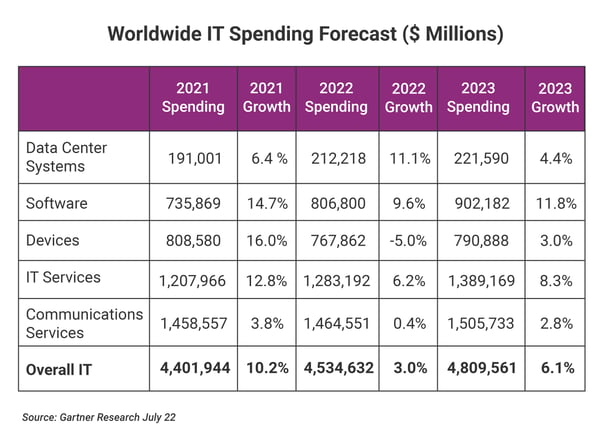

Forrester’s Global Tech Market Outlook projects that global tech spending will grow around 6% in 2022 and 2023. Expect to see even more spending trends in the tech market this year:

-

Software segment growth of 10.5% driven by cloud software, both software as a service (SaaS) and single-instance hosted applications.

-

IT services growth of 6.8% coming from the momentum generated by digital transformation projects through 2021 and rising labor costs.

-

North American spending growth of 7% within the industries accounting for three-quarters of US tech spending — financial services, professional services, government, media and information, telecommunications, data processing, and insurance — are reporting solid growth in revenues.

Every company participating in the digital economy can be considered an IT company these days. Therefore, they can’t just hit pause on digital transformation projects that allow them to stay competitive and improve their productivity.

Increased labor costs, as employers pay more to secure talent, is the key factor driving increased IT spending worldwide, particularly in software and IT services. That’s a trend that is expected to hold through 2023, according to Gartner's latest IT Spending Forecast.

Perfect Timing for Software Outsourcing

The talent crunch, combined with a general desire to reduce bloat and tighten balance sheets after two years of rapid growth, will see more companies turning to outsourcing as a solution.

“CIOs are using more IT services to assist in the lack of skilled IT staff,” says John-David Lovelock, distinguished research vice president at Gartner.

“Tasks that require lower skill sets tend to be outsourced to managed service firms to alleviate staff time, while critical strategy work, which requires high-end skills unobtainable by many enterprises, will increasingly be fulfilled by external consultants.”

That predicted uptick in outsourcing is verified by various industry sources. According to data from Statista about the US application outsourcing segment:

-

Software application outsourcing revenue is projected to reach $42.4 billion in 2022.

-

A compound annual growth rate (CAGR 2022-2027) of 3.9% in revenue will drive a market volume of $51.3 billion by 2027.

-

The average spend per employee in application outsourcing will reach $253 in 2022.

Worldwide, growth in outsourcing spending is expected to continue steady as well. Mordor Intelligence estimates the global IT outsourcing market was worth $526.6 billion in 2021 and will reach $682.3 billion by 2027, a CAGR of 4.1%.

Outsourcing is being pursued as a strategy to assist with application modernization and maintenance, cloud enablement, cybersecurity, automation, artificial intelligence and data analytics. Most big-name application developers have embraced outsourcing.

“Companies such as Slack, GitHub, Alibaba, and WhatsApp have successfully leveraged the benefits of outsourcing development,” Mordor intelligence notes. “During its initial days, WhatsApp, to keep operation costs low, resorted to Eastern Europe for tech talent. It hired offshore developers for the software build and kept its in-house employees focused on customer support and operations.”

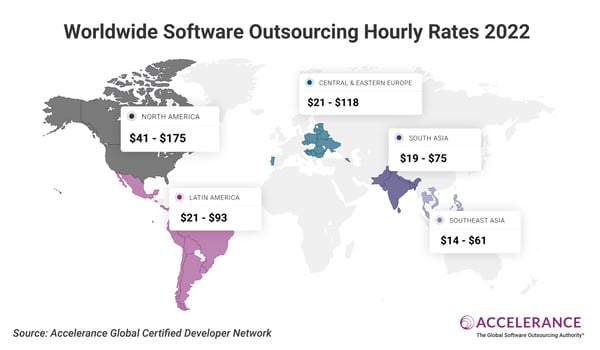

Across our network, we are seeing the trend toward companies engaging outsourcing partners across multiple regions. It's a strategy driven by the necessity to secure sufficient talent and expertise and to reduce the risks posed by geopolitical instability.

Benefits of Partnership in Uncertain Times

We saw more interest in outsourcing than ever during the Covid-19 pandemic. Now tech-driven businesses are looking to save costs and stay lean even as they carry on ambitious software, cybersecurity and cloud programs.

While outsourcing partners are facing their own talent acquisition struggles and cost pressures, they are still offering highly attractive software development rates that can achieve savings of 30% to 70% versus the cost of in-house development teams.

Industry experts recommend that IT leaders collaborate with their strategic partners on creative ways to manage expenses in the face of faltering demand.

“Those providers that can deliver demonstrated, quantifiable, financial value can and should continue to be rewarded by their clients...as this is key to successful growth in a recessionary environment,” Marc Tanowitz, managing partner in advisory and transformation at digital services firm West Monroe, told CIO.com.

Strategic outsourcing relationships proved their value during the pandemic. Companies that worked closely to problem solve with their outsourcing partners fared better in riding out the business disruption. That lesson applies as the economic downturn looms.

“Lean in with your partners,” adds Michael Fuller, principal at The Hackett Group, a strategic advisory firm. “They can figure out ways to streamline their delivery, migrate more work to lower-cost locations,” Fuller advises.

Those are the benefits of working with trustworthy IT outsourcing partners taking advantage of market dynamics in other parts of the world to offer world-class development services at attractive prices. That ability to "arbitrage" rates is the value offered by the Accelerance global network - see your potential savings in our 2022 Global Software Outsourcing Trends and Rates Guide.

The upward momentum signaled for the outsourcing market is reassuring to see. It confirms our belief in the value outsourcing can offer organizations big and small, particularly in times of constraint.

But outsourcing is hard to get right, requiring the right mix of people, technology and relationships along with culture, time zones, differing regulatory environments and geopolitics - with all playing a role in an engagement's outcome.

That’s why working with an experienced outsourcing expert like Accelerance makes sense. We’ve vetted 8,000 software outsourcing firms around the world, choosing the top 1% to match with the companies that work with us.

Accelerance is here to help you navigate business cycles with quality, cost-saving software outsourcing.

Rich Wanden

As Chief Customer Success Officer, Rich oversees Accelerance marketing and sales operations globally with a focus on helping customers make the best decisions for choosing a software development team and working together. Prior to joining Accelerance, Rich has worked in management consulting, IT advisory and...

Recently Published Articles

View All Posts

Best Practices

August 17, 2023 | Rich Wanden

The Future of Software Outsourcing: Trends and Predictions for 2024 and Beyond

Blog

August 25, 2023 | Rich Wanden

It’s Prime Time for Software Product Management: Are You Ready?

Best Practices

August 1, 2023 | Rich Wanden

Why Play Russian Roulette?: Understanding the Quality Gap in Software Outsourcing Providers

Subscribe to email updates

Stay up-to-date on what's happening at this blog and get additional content about the benefits of subscribing.